CREATING A BUDGET DURING A CRISIS + FREE PRINTABLE!

Wow. What a mess the last couple of months have been. With over 22million people applying for job loss benefits in the USA and that number rising daily, I thought this was the perfect opportunity to look at those tense budget numbers. So creating a simple budget plan during this crisis is so important to help you manage your cash flow!

YOU CAN SEE THE ORIGINAL POST HERE

Hi, Nicola here from My Inner Creative, and let me tell you now, this is going to be a tough, hard conversation, and I am no financial advisor but I was blessed with 2 amazing parents who taught me how to budget really well, for all seasons and I’ll share that with you now.

If you would like to see some amazing finance trackers check these out

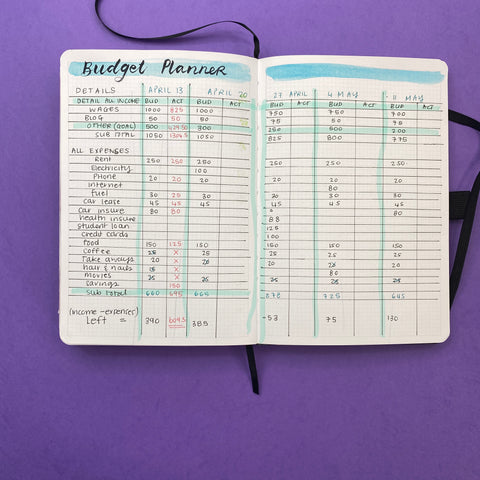

Before we get started, let’s first print out this budget planner.

Watch our step by step crisis budget video!

Taking Stock of your budget incomes and expenses

If this is your first time doing a budget, we will go through this slowly, Income is any money you are getting, this could be from parents, from your job, from the government, from selling things. Your expenses are everything you spend money on, some expenses are fixed, like rent and food, where some expenses move around like car repairs.

So let’s first take a look at all those expenses, IN DETAIL! For this illustration, I am going to work with a weekly budget which is apparently how most of our amazing followers in the USA get paid.

On the top we are going to list all your sources of income, and on the bottom we are going to list all your weekly expenses, if they are monthly expenses multiply them by 4 to be able to work out the cost. To make this easy, I have created a wee template you can print out!

Once we have set out looking at your finances in detail – let’s have a look at your debts

Taking a good look at money you owe (debts)

When looking at your debts make sure you include how much the debt started at, the interest rate, when it is due and finally how much you still owe. This will help you to determine which to attack first. Now if you are a fan of Dave Ramsey’s financial plan, he always says to focus on the smallest debt first to get some momentum for paying those debts off!

Plan out your budget for the next 3 months

Once you have had a good hard look at your finances currently, lets plan out the next 3 months so that you know exactly what your situation is and how to manage this.

Remember to include when your bills are due and make sure you are setting yourself goals and try your hardest to stick to the budget as much as possible to get through this really difficult time.

A list of things you could do to make additional income in these tough times!

When you open up your mind, there are so many additional (and legal ways) you can make money! If you want 15 more additional ideas you can check some out here:

- Once we have had a long hard look at your budget above, then cut out anything that is not important right now. Be brutal!

- Sell good quality clothes and shoes you no longer use

- Sell any items in your house that you no longer use but are still in good quality

- Are you willing to do some market research? Some market research companies will enroll you and be willing to pay you cold hard cash to participate!

- Cut out frivolous spending

- Try to maximise your tax return

- Set yourself up for transcription, if you have a computer and can type well, look into charging out your time to transcribe.

- Do you have any transferable skills? Why not look at becoming an online Virtual Assistant?