Organizing your finances in your bullet journal + Free Printable

TWO THINGS BEFORE WE START! 1. I am no way a financial advisor, the following is just my opinion and what has worked for me. 2. The freebies are down at the bottom of the page!

Finance talk can be seen as sensitive. It can be seen as tricky. BUT what ever your situation, you should be able to manage your finances in such a way that allows you to start working towards more financial security. Sometimes, just sometimes, its all about your mindset and how you actually think about money!

My money mindset was the creation of having 2 parents who were accountants, one who was very frugal and one who would spend money with reckless abandon. I should have probably followed more in the footsteps of the one that was more frugal and financial sound, however, I think I have now struck my own personal balance.

Some of the things that drove me to this particular post was an incredibly inspirational podcast from a woman called Canna Campbell who runs “SugarMumma” this is an extremely resource rich site for those wanting to get ahead of their money challenges.

What really stuck out for me was what she said around making additional income, it can be anything, from selling unwanted goods in your home, to starting a side business. It was really interesting how she managed money and you can here the interview with her here the ladies from Mamamia interview her and I really enjoyed it! You can buy her really clever book below:

Canna says in her interview says “I wanted to prove to people to stop being limited by your salary and defining your financial situation by your salary. I’m sick of hearing people say ‘I can’t afford to invest, I only earn $50,000 a year or whatever that number may be”

Later in the the interview she also says:

“When you open up your mind there are so many ways you can actually earn money.”

So that is what we are going to address today and put some work into making bullet journal spreads that support your new found financial mindset!

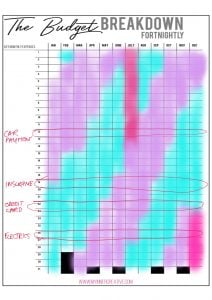

Using your bullet journal to track your finances

For me I get paid fortnightly, so what I have personally done is divide my month into 2, and where the “fortnight” of pay falls, it either covers the first week or the second week of the month. And whats great, is every so often (for me its 1 Jan and 1 July) I have an extra fortnight, which doesn’t cover the start or the end of the month, and that all goes straight into savings or towards my financial goals. I have a combination of fortnightly payments that come out, as well as monthly payments. By using this technique I know I always have money set aside for those bills and expenses that are regular. I have included this in the spread printable! So essentially I track in my fortnightly calendar when monthly vs weekly vs fortnightly payments come out and group them together. Overall throughout the year the payments do not change, so if I make sure I separate out my expenses every month, I have all those bills covered. I have a separate account for bills and I dont touch this under any circumstances.

Using your bullet journal to change your mindset about money

Changing your money mindset can be challenging, Its about changing the way you think about money. In his podcast on “Morning habits of the rich” with Lewis Howes it really highlights that change in thinking and how simple but daily activities can bring you closer to your goals. His is podcast he states:

People are fascinated by habits and routines, and people are always curious about making more money. So, I said, “Well, what are those things that you can do, in the morning routine, those habits in your morning routine, that will help you make more money that day?”

Lewis also recommends the following book as a good starting point!

As bullet journalists we track things so here we go! Best hint is to track your money behavior. What sorts of things should you track?

Lewis goes on to talk about self made millionaires doing the following things:

- They read a lot and keep learning new things. They read, learn, adapt and grow. We can definitely take a page out of that book!

- They practice healthy lifestyles, wellness and fitness

- They spend time with successful people, they make time to talk to them. Is there someone who inspires you (within reason) that you could reach out to? Or could you join your local business owners group, or even something more specific to the work you do? There should be a groups on Facebook and if not, why not start your own? Lewis says “You got to go find groups and communities, you can find people online, you can go meet people at meet ups, who are doing things at a different level. I’m not saying everything is going to be easy, but there are things that you can seek out and start to pursue.”

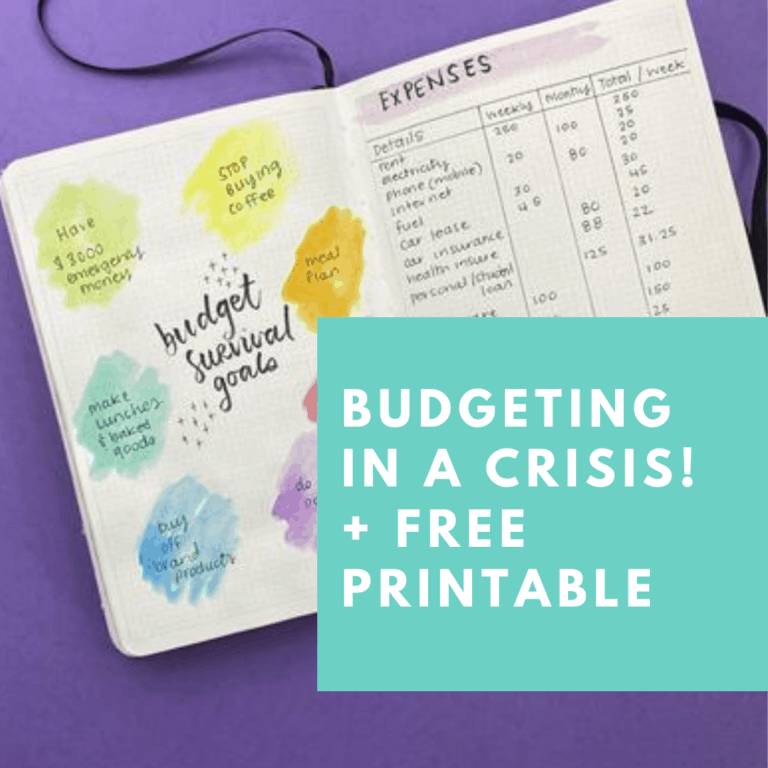

- Rich people have goals and they persue them. While we might set ourselves up a cute savings tracker, what is the actual goal, in the printable I have included a goalsetting sheet to help you start planning that goal. Get really crystal clear on that goal. Visualise it and allow yourself to believe that goal is at your fingertips!

- Apparently the 5th habit is to get up early and be productive. Now I cover this in an earlier blog post where I talk about getting up an hour early to do my miracle morning.

- They do not just focus on one source of income, they focus on many, and I think this is where Canna’s work arounf the $1000 project can come in. She highlights that you can make money in a multitude of simple small ways and suggests the following:

- eBay

- Gumtree/Craig’s List

- Extra work – weekends or after hours

- Market Research

- Babysitting

- House sitting and looking after pets

- Dog walking

- Tutoring

- Garage sales

- Pay rises

- Tax refunds

- Bonuses/Commissions

- Small business

- Asking for cash instead of birthday present

7. Another habit is that they check in with mentors. Holding yourself accountable is key and highly instrumental in you reaching your goals.

8. They are almost always positive and optimistic. Back in 2016 I was without a Job for 3 months. This was really hard on me and I took a really structured approach to the situation and set a goal, started networking, contracting and doing odd jobs to make ends meet during that time. For me, it wasn’t sustainable for me because I have a son a needed regular income, but it taught me that it was achievable, and I worked really hard at finding a job I loved (the one I have now haha!)

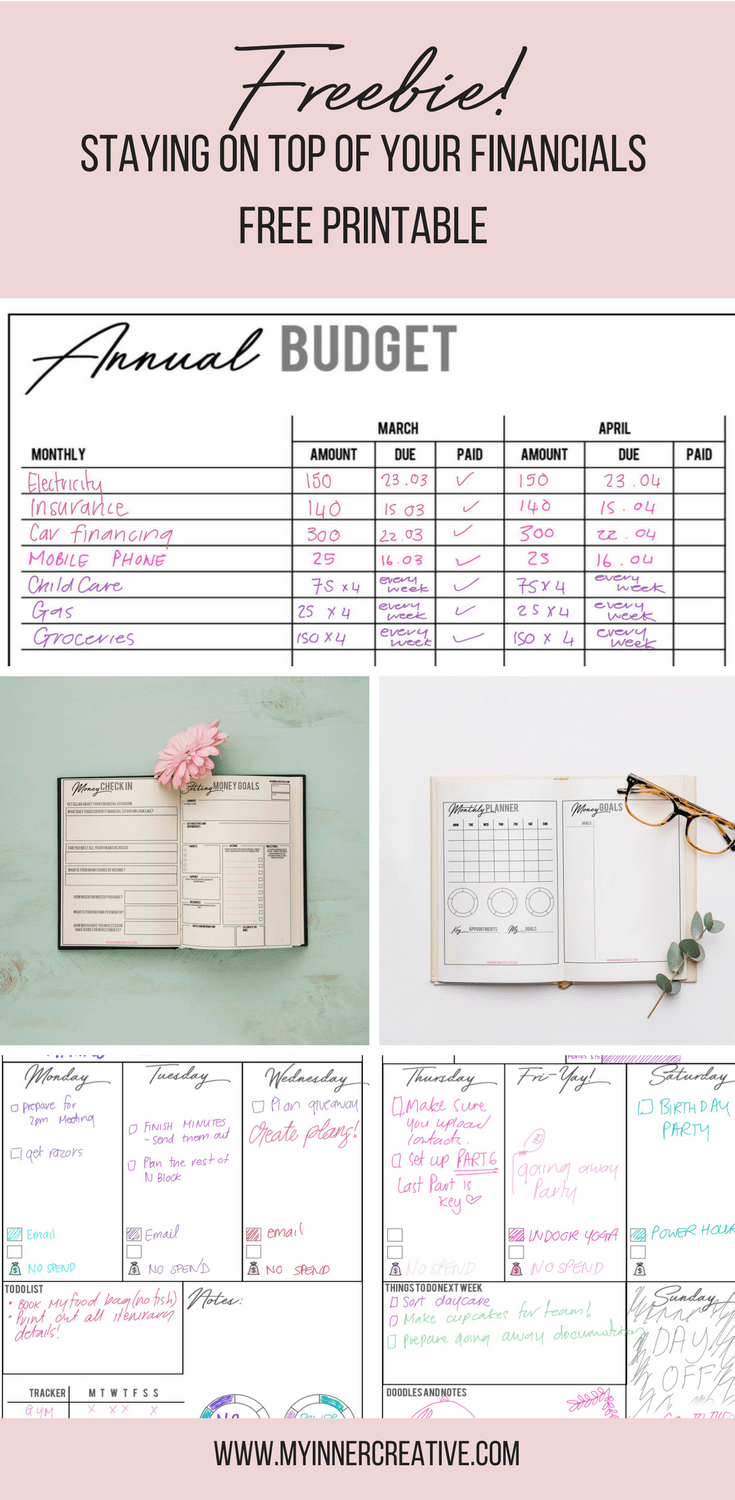

Printable bullet journal finance tracker

In the first part of the printable, we cover your money mindset, and how you can proactively change the way you think about money.

Then we hit the meaty stuff – budget setting, goal setting and a weekly spread to help get you there! Within the post we have the following pages and features

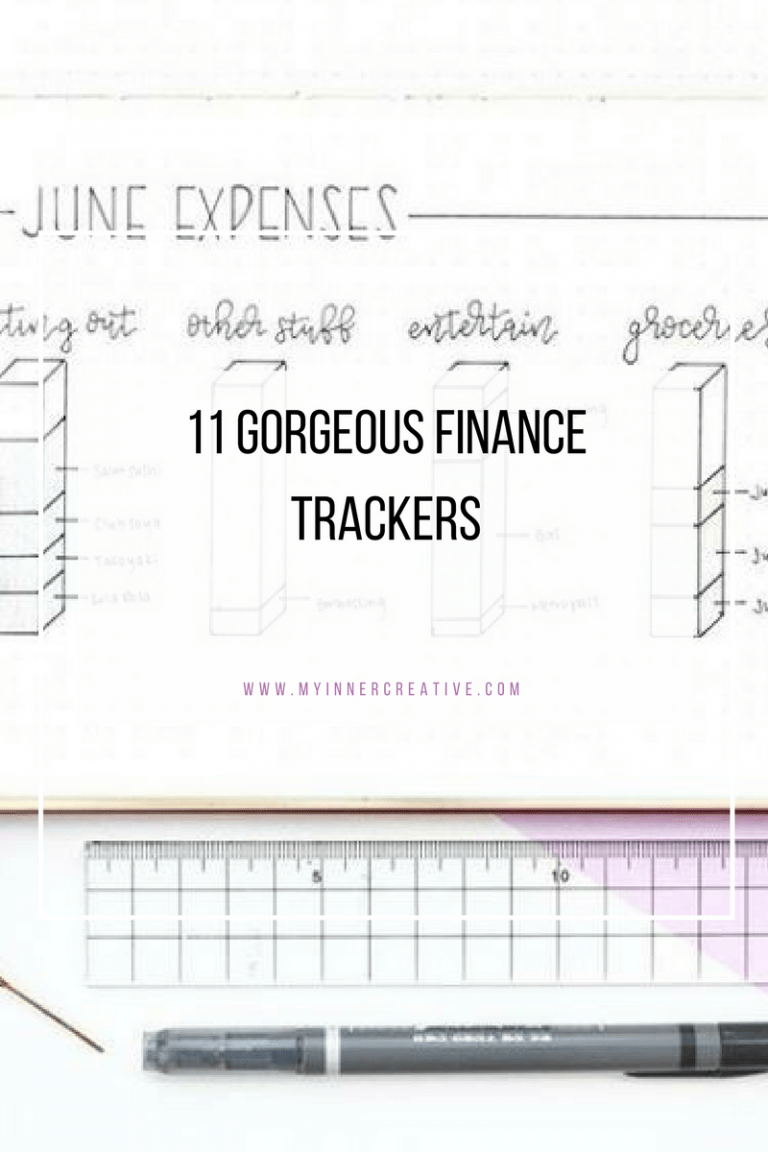

- Annual budget tracker with a pixel tracker for your monthly spend

- A weekly, monthly and fortnightly budget planner

- Your money goals

- Your wish list

- Monthly planning spread with 3 circles to track your steps towards your goals

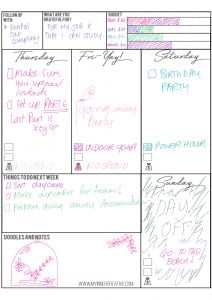

- Weekly spread containing the usual things you need for your week, but also has space for budget tracker, general weekly tracker, affirmations etc.

In the free printable below we cover off your money mindset and have the following features:

- Money check in – assessing your current financial status

- Mindful Money health check – how do you personally feel about money?

- Positive changes to make

- Money Affirmations (to include on your weekly spreads, we have a little space for affirmations)

- Setting money goals!

Free Printable

Your Financial Health Check